It is always difficult to move house considering the amount of complexity with so many new home loan financing rules, additional buyer stamp duties (ABSD), Financial & time line planning, etc.

Buying a property is stressful especially if you are switching from HDB to Private Condominium. This is because the timing of purchase and sale is of critical importance, one wrong move could lead to a cash crunch.

| PROS | CONS |

|---|---|

|

|

| PROS | CONS |

|---|---|

|

|

| The best way I want to….. |

|---|

|

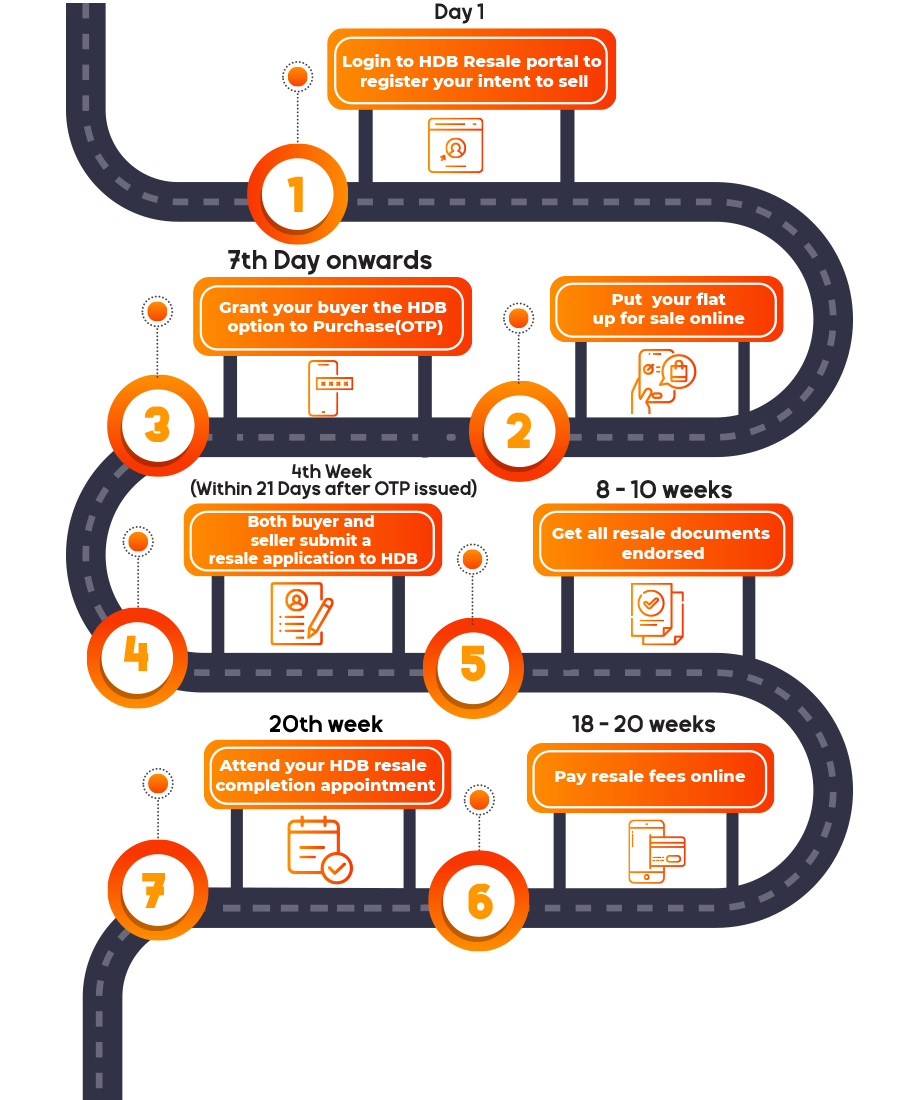

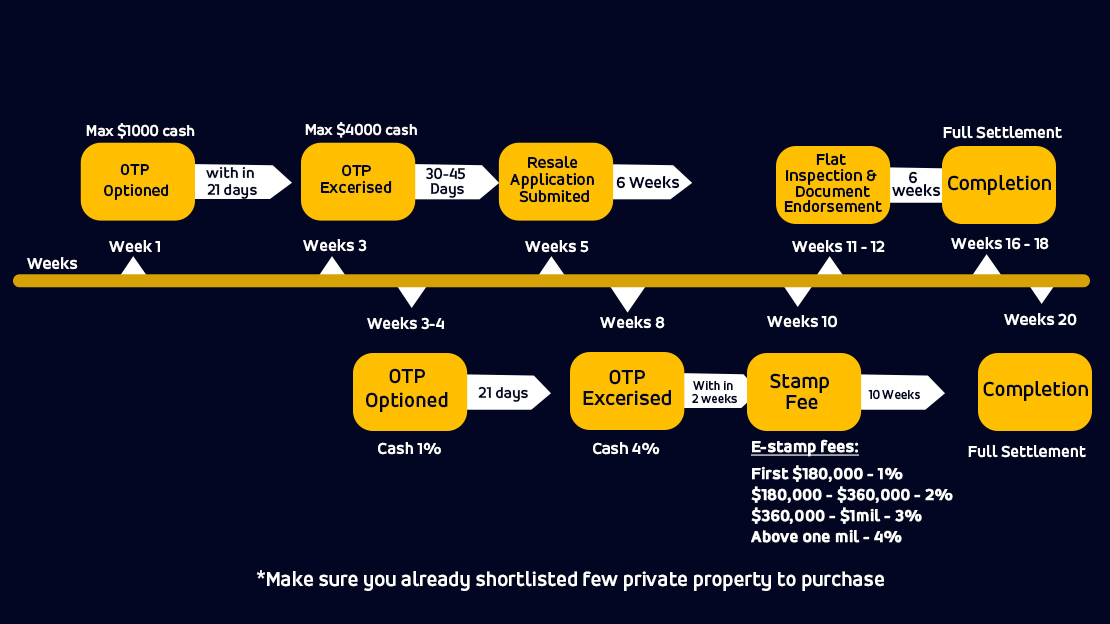

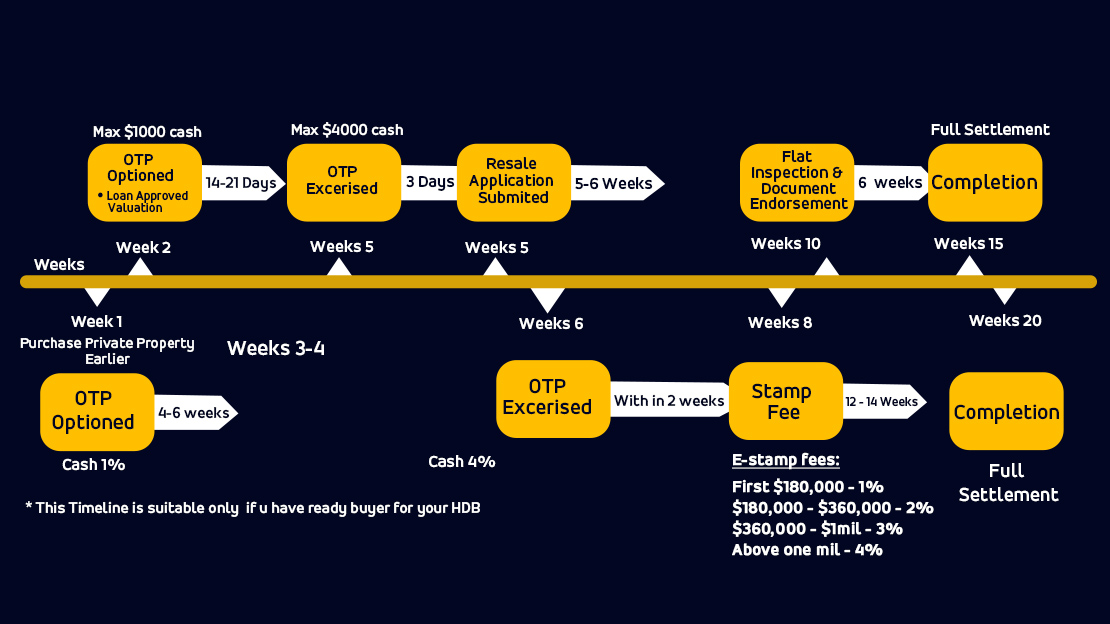

To achieve you’re the above, You need a property agent like me to assist you to source for a private condominium while at the same time put your HDB flat up into the market.

Me and Lawyer can assist to set your OTP Exercise date much later after you deposit, it is called an Option to purchase (OTP) of 1%.

At the same time, you quickly sell your HDB flat. Bear in mind, your HDB flat must exercise option before your Condominium’s exercise date to qualify for NO Additional Buyer Stamp Duty (ABSD) as the ABSD is measured based on the exercise date, not the option-to-purchase date.

At the point of your exercising your Private Condominium Option-to-purchase (OTP) you do not own a residential property, you have already “Sold” as the buyer of your HDB flat exercised option on your HDB flat.